“Desperately seeking!” said the ad. “As financial controller you will actively cooperate with management and internal units in budgeting and forecasting and provide forward-looking insight. You will initiate and build plans to achieve forecasting results and ensure long-term value creation.”

Finance is a critical support department to underpin the longevity of an organization. The insight that financial controllers provide is vital for well-informed planning and long-term value creation. But two-thirds of executives say that finance teams are “too busy doing financial management duties”.

Working with a financial ERP system for the data and spreadsheets for analysis, your financial controller was always at least one night shift away from even starting on value-adding activities. Maybe she ventured into coding and built a solution with SQL,VBA, Access, and Power BI for more efficient data transformation and consolidation work. But now she’s gone, and with her, a lot of valuable know-how.

There’s no-one left to manage those complex coded models for value creation.

So, what are other finance teams doing differently?

The key to driving value creation is to transform finance with a focus on technology, data, and analytics and should be one of the top three priorities for finance leaders. Research shows that the best-run teams ensure all finance processes are supported with key skills and capabilities. These include understanding the underlying business, building effective relationships outside of finance and accounting, and ensuring teams are equipped with the relevant technical skills.

Let’s take a closer look at these statements.

How to enable a focus on technology, data, and analytics

While finance leaders recognize the value of focusing on technology, data, and analytics to drive long-term value creation, it can only be achieved with large-scale analytics upskilling.

The biggest entry barrier to large-scale analytics upskilling is user-friendliness of the tool. Not everyone will have the same level of technical competence, so a tool that opens up access to analytics for non-technical users, while not compromising on analytic depth for experts, will garner broader acceptance.

At the German Chambers of Industry and Commerce (IHK) Jörg Endter teaches data analytics with the low-code, no-code KNIME Analytics Platform. KNIME makes advanced analytics techniques accessible to even non-technical users through an easy to use interface, without compromising on analytic depth for experts.

“KNIME is user-friendly, lowering the entry barrier to the world of data, and enables fast developments with satisfying and valuable results. Participants don’t need previous programming experience, just an affinity for data,” says Endter.

How to provide support for relevant technical skills

The difficulty in providing support for technical skills is that there are so many of them. Accounting professionals today are expected to be highly skilled in multiple areas: from basic spreadsheet work to financial modeling, forecasting and budgeting through to process automation, and AI. If a team is primarily working in spreadsheets, lack of access to advanced analytics techniques will be a barrier to enabling automation and using emerging technologies e.g., like the state of the art OpenAI and LLM models.

Finance teams are best supported with a tool that has no limits on analytic capabilities, from simple data collection and prep through to machine learning and AI for complex modeling or automation. To be future-proof, the tool needs to be abreast with the evolving data science landscape.

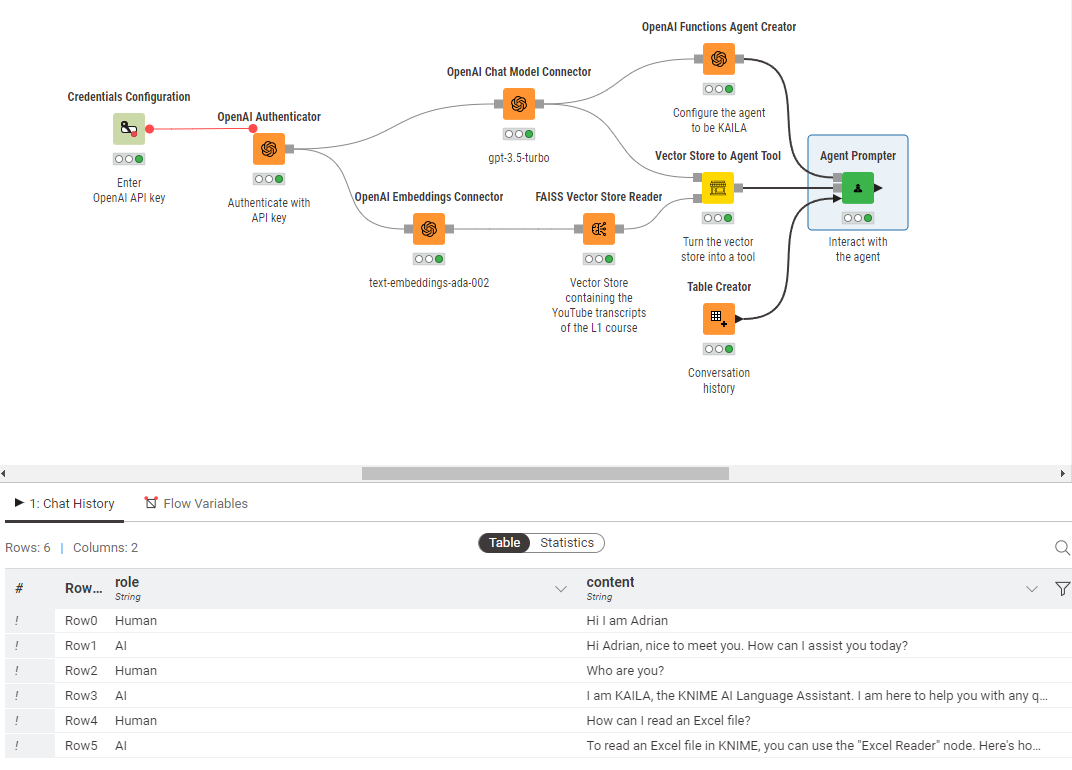

Open platforms ensure teams can work with the latest analytic techniques that commercial vendor-driven platforms can’t keep pace with. One of the most recent additions to KNIME is K-AI, a new AI assistant based on ChatGPT, which helps onboard new users by answering questions and even building workflows automatically based on their directions.

How to integrate underlying business understanding

Finance teams need to be proactive in expanding their business understanding. It’s this knowledge that sharpens business objectives and enables them to build excellent analyses because they understand the data. They can immediately spot when something is “off” in an analysis. Typically, however, the finance team will be working with the data team to build an analytical solution, with multiple to-ing and fro-ing between the teams to transfer knowledge. This results in considerable translational error.

When finance teams are enabled to build analytical solutions themselves, they can inject their expertise into the models, improving the accuracy of results. Effective relationships outside of finance and accounting are developed when the analytical insight is shared easily across the organization as reports, services, or interactive data apps.

A case in point: How KNIME enabled finance teams to build analytical automation tools with IT

The finance team of a Corporate Real Estate (CRE) company, managed by Day5 Analytics, leveraged KNIME to automate their spreadsheet processes, drive efficiencies, with a solution that enabled them to work across departments.

Cost accruals form a significant component of monthly costs for most companies. Accurate accruals result in accurate monthly financial statements, which CRE clients use to monitor spend and make strategic budget decisions. Previously, several account teams would complete their accrual calculations each month. This manual process involved downloading CSV files from the Financial ERP, converting to Excel, and performing several sequential calculations to determine the accrual amount. As multiple account teams were repeating these procedures each month, the process happened hundreds of times a year. Any improvement in efficiency would make a big impact.

5 weeks of time-savings with the data science solution

Finance ERP reports are now automatically downloaded into a single folder. KNIME reads through each of the files and applies business rules, tailoring accruals to each CRE client’s nuances. The generated accrual is then reviewed by Operations staff, who ensure the cost aligns with the actual work delivered. KNIME then consolidates the input received from Operations and creates upload-ready templates for the Financial ERP system.

Read more in How Day5 Analytics centralized and automated 500 financial processes.

The core process has been centralized and automated, to enable time-savings of 5 weeks per year. The new, nimble solution scales to support more account teams without a proportional increase in headcount, and results in additional value creation for the organization.

Sustainable analytics for long-term value creation

The low-code, no-code solution with KNIME enables finance teams to build analytical automation tools independently, injecting their domain knowledge to truly leverage the underlying data and reveal previously hidden insight.

(With everyone on the team now enabled to work with advanced analytics, we can take down that ad.)